OJK Issues Three Guidelines for Islamic Banking Products

- VIVA/Andry Daud

Jakarta, VIVA – The Financial Services Authority (OJK) continues to develop the Islamic finance ecosystem in Indonesia by issuing three new guidelines as part of its efforts to strengthen the unique characteristics of Islamic banking.

Dian Ediana Rae, OJK's Chief Executive for Banking Supervision, explained the three guidelines, which include the Mudarabah Financing Product Guidelines, the Implementation Guidelines for the Shariah Restricted Investment Account (SRIA) with the Mudarabah Muqayyadah contract, and the Cash Waqf Linked Deposit (CWLD) Implementation Guidelines.

"OJK is developing Islamic banking products with distinctive shari'ah-based characteristics, creating a unique value proposition that conventional banking cannot offer," Rae said on Sunday (Oct 27).

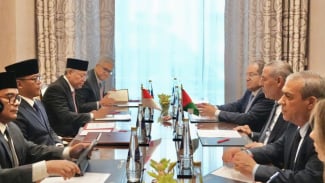

Kepala Eksekutif Pengawas Perbankan OJK, Dian Ediana Rae

- VIVA.co.id/Anisa Aulia

Rae stated that the issuance of these guidelines reflects OJK’s commitment to strengthening the characteristics of Islamic banking through strategies that develop unique Islamic products, in line with the 2023-2027 Roadmap for the Development and Strengthening of Islamic Banking in Indonesia (RP3SI).

“These product guidelines prepared by OJK are expected to provide guidance for the industry and stakeholders in implementing Islamic banking products, ensuring a common perspective and understanding in their application,” he concluded.