Tobacco Price Stability Ensured by Customs Monitoring in Market

- Bea Cukai

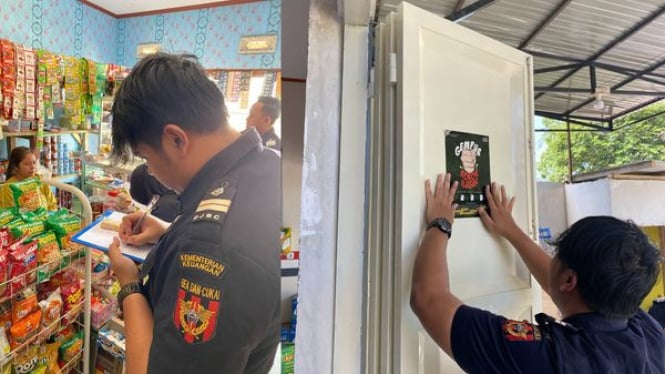

Jakarta, VIVA – Customs continues to monitor market transaction prices of tobacco products for Q3 2024.

The Customs Office is actively monitoring the market transaction prices (HTP) of tobacco products for the third quarter of 2024.

Six vertical units of Customs simultaneously conducted this activity at the beginning of September 2024 in Bekasi, Semarang, Yogyakarta, Pangkalpinang, Tarakan, and Morowali.

Panen tembakau petani Indonesia. (ilustrasi)

- ANTARA FOTO/Anis Efizudin

This price monitoring is part of the implementation of the Directorate General of Customs' Circular Letter No. SE-5/BC/2022 regarding the Monitoring of Market Transaction Prices for Tobacco Products.

Budi Prasetiyo, Head of the Customs Public Relations and Counseling Subdirectorate, stated that the monitoring is carried out by visiting modern and traditional stores.

"We will compare the retail selling prices on the tobacco tax stamps with the prices set by sellers, and we will also record the types, contents, brands, and manufacturing companies," he said.

According to Prasetiyo, this monitoring serves as a basis for determining tax policies, particularly for tobacco products.

"Through this monitoring, we can ensure that the selling prices of cigarettes in the market do not exceed the established limits," he remarked.

Tobacco tax is one of the sources of state revenue. The Ministry of Finance has established tax regulations for each tobacco product through various regulations.

The tax rates for tobacco products such as cigarettes, cigars, leaf tobacco, and shredded tobacco are regulated under PMK No. 191/PMK.010/2022, while electronic cigarettes and other processed tobacco products are regulated under PMK No. 192/PMK.010/2022.

"In addition to monitoring, we also educate tobacco sellers about the regulations regarding illegal cigarettes, general characteristics of tobacco tax stamps, and how to report illegal tobacco circulation to Customs," he concluded.