Jokowi Urges OJK, Bank Indonesia to Improve Digital Financial Security

- Dok. Biro Pers Sekretariat Presiden

Jakarta, VIVA – President Joko Widodo (Jokowi) reminded Bank Indonesia (BI) and the Financial Services Authority (OJK) to increase protection in the digital economy sector.

It's because the financial literacy of the Indonesian people is still low, so protection must be provided so as not to give disadvantage.

The head of state made this statement while attending the opening ceremony of the 2024 Indonesia Digital Financial Economy Festival and the Indonesian Creative Works (FEKDI x KKI) at JCC Senayan.

"I urge the Financial Services Authority (OJK) and Bank Indonesia (BI) to enhance protection in the digital economy sector, as our financial literacy is still low," President Jokowi said in a statement.

According to the head of state, financial literacy is less than 50 percent, making it vulnerable to fraud and digital crimes.

Presiden Joko Widodo (Jokowi)

- VIVA/Ahmad Farhan Faris

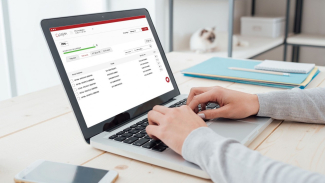

Therefore, he emphasized that OJK and Bank Indonesia must prepare a consumer protection system to ensure that consumer data security is not easily breached.

"Prepare a consumer protection system, ensure the security of consumer data so that small people are not disadvantaged," the President remarked.

Moreover, President Jokowi stated that data security is crucial and backup must be implemented in layers.

"Data security is very important, we must not be unprepared and lack layered data backups," he said.

The President added, "I request layered data backups so that users, the public, can transact safely. This is important. I believe our recent experiences should be valuable and beneficial for the future,"

In addition to pressing for enhancing data security, he also called on the central bank and the OJK to increase protection in the field of the digital economy, considering that there are 64 million micro, small, and medium enterprises in Indonesia.

He cautioned that low financial literacy makes the public vulnerable to digital-based fraud and crimes.

The government is continuing to develop the digital economy in line with the 2030 National Strategy for Digital Economy Development.

The pillars of digital economy development include strengthening infrastructure, human resources, business climate and cybersecurity, research on innovation and business development, and financing and investment, as well as pushing credible policies and regulations.

By optimizing digitalization efforts and promoting financial literacy and education, Indonesia can comprehensively accelerate its digital economic development towards becoming an advanced country.