Bank Indonesia Unveils Payment System Blueprint for 2025-2030

- Dok. VIVA.co.id

Jakarta, VIVA – Bank Indonesia (BI) unveiled the latest roadmap of the Indonesian Payment System Blueprint for 2025-2030.

"To accelerate the digitalization of national payments," Governor of Bank Indonesia Perry Warjiyo said at the Indonesian Digital Financial Economy and Creative Works Festival (FEKDI x KKI) at JCC Senayan, Jakarta, Thursday (August 1).

Through this, Warjiyo ensures that Bank Indonesia will accelerate the digitalization of the national payment system which is focused on 5 main initiatives.

The five initiatives are modernization of retail payment infrastructure, consolidation of national payment industry data, digital innovation and acceptance, expansion of international cooperation, and development of digital rupiah.

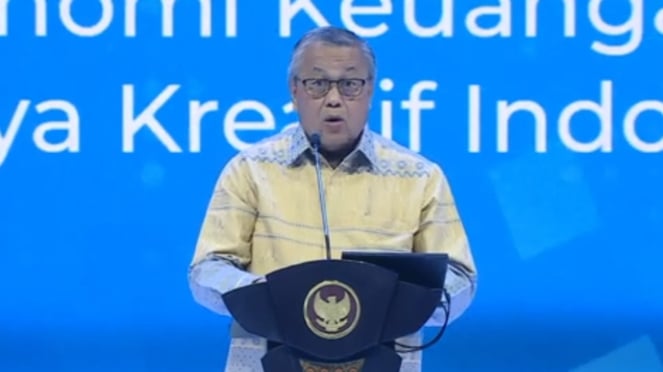

Gubernur Bank Indonesia (BI), Perry Warjiyo, di acara Festival Ekonomi Keuangan Digital dan Karya Kreatif Indonesia (FEKDI x KKI) di JCC Senayan, Jakarta, Kamis, 1 Agustus 2024

- VIVA.co.id/Mohammad Yudha Prasetya

In the initial phase of BSPI 2019-2025, Warjiyo explained that BI had previously focused on five visions of Indonesia's payment system.

The five are national digital economy-financial integration, utilization of banking financial business digital data, and interlink between fintech and banking.

Then, there is digital innovation, risk mitigation, and consumer protection; and the expansion of cross-border payment systems.

Furthermore, Warjiyo said the development of digital rupiah is currently included in the focus of BSPI 2030 development, and is in the concept finalization and validation stage.

At this phase, Bank Indonesia is still trying to finalize the technology to be used, whether it will be centralized or decentralized.

"We're in the process of choosing the supporting technology, whether our digital rupiah will be centralized or decentralized," he said.