OJK, MUI Agree to Strengthen Sharia Financial Service Sector

- VIVA.co.id/Anisa Aulia

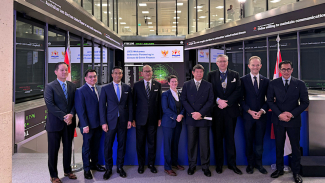

Jakarta – The Financial Services Authority (OJK) and the Indonesian Ulema Council (MUI) have signed a memorandum of understanding (MoU) to develop and strengthen the Islamic financial services sector in Indonesia.

This cooperation includes enhancing the capacity and competence of human resources as well as providing services for complaints and consumer protection.

Meanwhile, Indonesian Vice President, Ma’ruf Amin emphasized the importance of building cooperation with all stakeholders to develop the Indonesian people and nation.

Ilustrasi keuangan syariah

- Halomoney

"MUI has two visions, serving the people and being a government partner. The government also has the same mission, so MUI is building cooperation in all activities," said the VP Amin in a statement on Tuesday (May 7).

Meanwhile, Chairman of the Indonesian Ulema Council, Anwar Iskandar, expressed appreciation for the signing of the Memorandum of Understanding between OJK and MUI, which is expected to develop the Islamic economy and be beneficial for the Indonesian nation.

"Thanks to OJK for efforts to empower the Islamic economy. Hopefully, this will be a definite and clear action that benefits the prosperity of the Indonesian nation and people," Iskandar expressed.

The role and function of OJK and MUI are strategic steps in increasing public trust in the Islamic financial services sector.

In the implementation of the MoU between OJK and MUI, there will be further discussions and deepening of the technical aspects of cooperation, either in the form of a Cooperation Agreement or other forms.

This MoU is a joint step for both institutions to strengthen the Islamic financial services sector and realize inclusive community participation in national development through Islamic economic and financial instruments, including through the provision of Sharia-compliant financial products/services.