OJK Launches Low Carbon Financing Guidelines for Indonesian Banks

- VIVA/Andry Daud

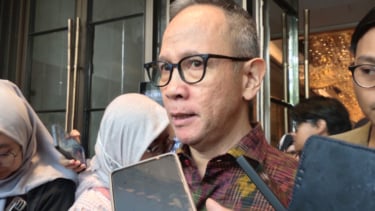

Jakarta – Chief Executive of the Banking Supervision Authority of the Financial Services Authority (OJK), Dian Ediana Rae stated that as an effort to assess the resilience of banks' business models and strategies in facing climate change risks, OJK have launched the Climate Risk Management & Scenario Analysis (CRMS) guidelines for the banking sector.

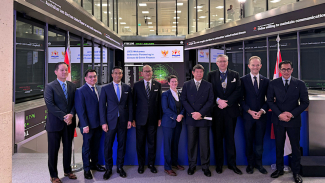

This was also marked by the signing of carbon emission zero commitments by representatives of 7 banks in the country, namely Bank Mandiri, BRI, BNI, BCA, BSI, BPD Jabar and Banten, as well as Bank CIMB Niaga.

Kepala Eksekutif Pengawas Perbankan OJK, Dian Ediana Rae.

- istimewa

Rae emphasized that the launch of CRMS is a manifestation of OJK's support in managing climate management risks and a step towards achieving the net-zero emission (NZE) target by 2060.

"So, this becomes a role for all of us stakeholders, including the banking sector, which plays significant role in channeling low-carbon financing in line with government policies," Rae said at the CRMS Launch event in the Setiabudi area, South Jakarta, on Monday.

He outlined three urgencies of the CRMS launch for the banking sector. First, because Indonesia is one of the countries vulnerable to the impacts of climate change phenomena.

"Indonesia ranks third in countries most exposed to physical risks, and seventh in the world for highest emissions," he remarked.

Second, urgency is to support global and Indonesian NZE commitments.

Third, urgency is the need for CRMS to become an international direction and standard regarding climate change issues.

"Moreover, the concept of CRMS for banks also consists of governance, strategy, and risk management that can be used as guidance in facing climate change," Rae stated.

It's known that the CRMS guidelines for the banking sector consist of six books.

Book 1 is the General Guide, Book 2 is the Technical Guide, Book 3 is Emission Calculation, Book 4 is NGFS Data, Book 5 is Disaster Data, and Book 6 is the CRST Working Paper.

OJK's CRMS guidelines are a living document, or will continue to be perfected following regulatory developments, best practices, and stakeholder interests.