Global Economic Policy Gives Potential Signal of Recession

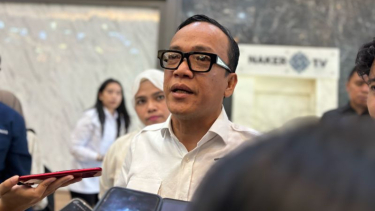

- VIVA/Muhamad Solihin

VIVA – Several parties and financial institutions continue to voice that the biggest challenge in 2023 is the high uncertainty factor of the global situation that will occur in the future.

In fact, not a few people say that the probability or chance of a global economic recession in 2023 is also increasing. This has also led to the rise of predictions about the 'gloomy' situation in the global economy.

Responding to this, Senior Analyst from the Indonesia Strategic and Economic Action Institution, Ronny P Sasmita explained that the occurrence of a global recession depends on the policies taken by major countries.

"Like for example America, China, the European Union, Japan, and several other countries, both macroeconomic and monetary policies," Ronny said when contacted on Monday, Feb. 20, 2023.

Ilustrasi resesi ekonomi/krisis ekonomi global.

- Freepik

By looking at developments to date, Ronny admits that from the monetary side, the policies taken do tend towards recession. This is for example where major countries are competing to raise interest rates to tame inflation.

"This means that economic growth will be sacrificed to tame inflation. Because liquidity will tighten due to the increase in interest rates, which means that the rate of investment will be depressed and the absorption capacity of the economy of labor will also decline," he said.

However, from the fiscal side, Ronny said that even though big countries are generous in attracting debt, in the end, they also have to spend it carefully to balance the volume of money supply.

Because since the COVID-19 pandemic, the money supply has increased sharply which is one of the reasons for the high inflation in America a few months ago in addition to other factors such as trade wars and the Russia-Ukraine conflict.

"As a result, as we have seen, America's economic growth is only around 2 percent, China's economic growth has fallen to 3 percent, as well as Japan and the European Union," Ronny remarked.

Therefore, Ronny emphasized that the symptoms of the current global recession are only indications. But looking at the Fed's consistency in fighting inflation, where they still want to raise interest rates to reduce the volume of the money supply. So, inevitably the potential for recession is not decreasing but increasing.

Ronny recognized that the United States' situation is very similar to the conditions in the early 1980s during the stagflation era. Where America chose to tame inflation and sacrifice growth, resulting in a two-year recession after Paul Volcker raised interest rates very high.

"Because of this policy, BI finally took action. The Fed's interest rate hike encouraged capital outflows about two months ago, which made the rupiah almost break IDR16,000 per US dollar.” He remarked.

The increase in BI interest rates, which is quite high, can indeed reduce inflation but has the opportunity to choke liquidity and suppress investment due to high lending rates. If indications of a recession are getting clearer, because the potential risks are not only from the monetary side but also the real economy," he added.